<snip> Years ago, Wendy’s had a television commercial. A wonderfully ironic grandmother by the name of Clara Peller would exclaim at the top of her lungs “Where’s the Beef?” In looking back on the 2019 Senate Bill 1, we are left asking something similar.

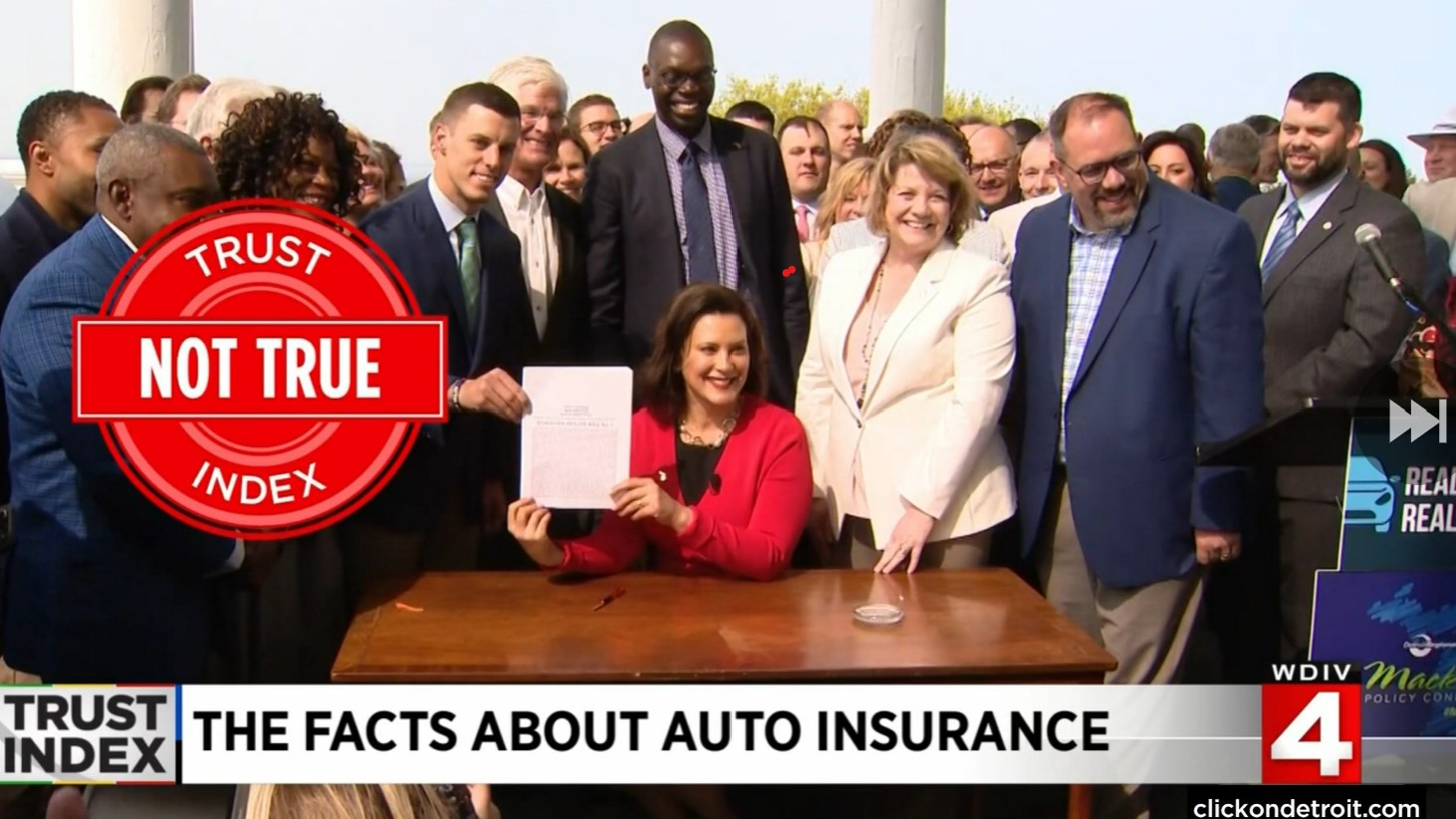

To steal a line from the Governor Whitmer, where’s the damn beef? When she signed the no-fault reform bill on a sunshiny Mackinac Island May afternoon, a smiling crowd of Democrats and Republican proudly congratulated themselves. No-fault change had been elusive for more than two generations. In this “reform,” they proclaimed, we Michigan drivers would get massive cost savings. They led us believe our highest-in-the-nation auto insurance premiums were a thing of the past.

Here’s the reality. Zebra.com, considered the auto insurance authority these days, tells us in its 2022 state by state auto insurance rankings: Michigan saw the following average annual rates dropped from $3096 in 2019 down to $2535 in 2020, an 18% decrease. But rates increased four percent in 2021 from $2535 to $2639.

So, we saw marginal savings at best.

Continued here, with a video: https://tinyurl.com/NoFaultReformFailure

If you have any questions about car insurance or the Michigan No-Fault law, be sure to contact us. We have been specializing in No-Fault law ever since it was created in Michigan in 1973. No one knows Michigan No-Fault insurance or car accident law better than the attorneys at Atkinson Petruska Kozma Hart & Couture, PC.

Northern Michigan’s Most Trusted Legal Team for Over 50 Years